21 Top Amazon Statistics For 2024 (Revenue, Market Share, And More)

Amazon is one of the largest online retailers in the world as well as the hosts of one of the leading global online marketplaces.

Amazon also offers a variety of services and products, including Amazon Prime, Amazon Business and AWS.

In this post, you’ll find the top Amazon statistics for the retailer’s revenue, market share and more.

Editor’s picks – Amazon statistics

Here are our picks for the top five Amazon statistics on this list:

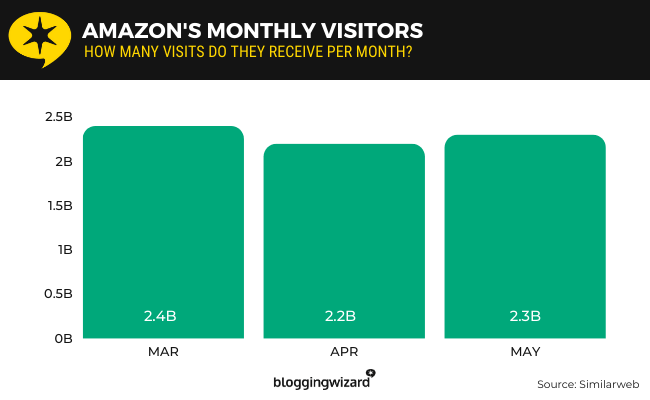

- On average, the official Amazon website gets 2.3 billion visits per month. (Similarweb)

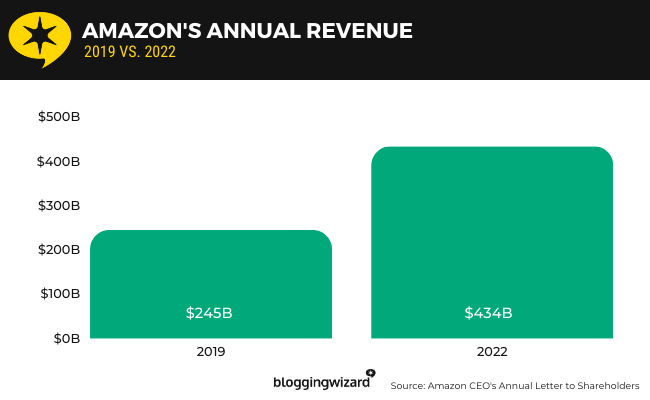

- Amazon had a revenue of $434 billion in 2022. (Amazon CEO’s Annual Letter to Shareholders)

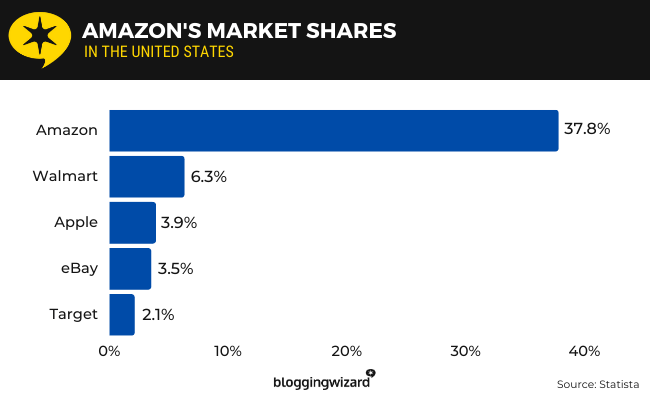

- In the United States, Amazon has a market share of 37.8% in the ecommerce industry. (Statista)

- Amazon Prime has over 200 million customers. (Amazon CEO’s Letter to Shareholders for 2021)

- Amazon’s primary Amazon Shopping app ranks No. 22 on the App Store. (App Store1)

General Amazon statistics

1. Amazon.com receives 2.3 billion visits per month on average

According to Similarweb’s data, Amazon.com received an average of 2.3 billion visits per month over a three-month period.

Visitors spend an average of seven minutes and 10 seconds on the site and visit an average number of 9.3 pages.

Amazon.com’s average bounce rate is 34.08%.

Other popular Amazon sites include:

- Amazon.co.jp (Japan) – This receives an average number of 550 million visits per month.

- Amazon.de (Germany) – 439.19 million visits per month.

- Amazon.co.uk (United Kingdom) – 354.03 million visits per month.

- Amazon.in (India) – 311.43 million visits per month.

Source: Similarweb

2. Amazon.com serves 300 million active customers

According to a new report published by Amazon about their latest venture Amazon Business, Amazon.com, Amazon’s main source of income, serves 300 million active customers.

Source: Amazon News Blog1

3. Amazon’s annual revenue for 2022 was $434 billion

According to Amazon CEO Andy Jassy’s annual letter to shareholders, published in April of 2023, the retailer’s annual revenue was $434 billion in 2022.

This was an increase of 77.14% from 2019’s annual revenue of $245 billion.

In the letter Andy said:

“This meant that we had to double the fulfillment center footprint that we’d built over the prior 25 years and substantially accelerate building a last-mile transportation network that’s now the size of UPS…all in the span of about two years.”

Source: Amazon CEO’s Annual Letter to Shareholders

4. Amazon’s market share is 37.8% in the United States

According to data published by Statista, Amazon has a market share of 37.8% in the ecommerce market in the United States.

This puts them well ahead of competitors like Walmart and eBay, who have market shares of 6.3% and 3.5% respectively.

This means the Amazon marketplace is likely one of the most popular online marketplaces worldwide.

Source: Statista1

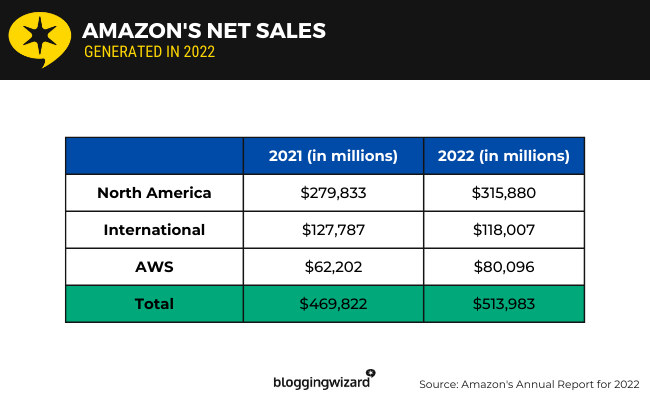

5. Amazon generated $513.98 billion in net sales in 2022

According to data revealed in Amazon’s annual financial report for 2022, the retailer generated $513,983 million, or $513.98 billion, in net sales by the end of 2022.

This is a 9.4% increase from 2021’s net sales of $469,822 million, or $469.82 billion.

The retailer broke this figure down into three areas of business: North America, international and Amazon Web Services (AWS).

| 2021 (in millions) | 2022 (in millions) | |

| North America | $279,833 | $315,880 |

| International | $127,787 | $118,007 |

| AWS | $62,202 | $80,096 |

| Total | $469,822 | $513,983 |

Later in the report, Amazon breaks their net sales down even more.

The retailer stated that $242,901 million, or $242.9 billion, of net sales in 2022 came from product sales while $271,082 million, or $271.1 billion, came from service sales.

They broke these numbers down into the following categories:

| 2021 (in millions) | 2022 (in millions) | |

| Online Stores | $222,075 | $220,004 |

| Physical Stores | $17,075 | $18,963 |

| Third-Party Seller Services | $103,366 | $117,716 |

| Subscription Services | $31,768 | $35,218 |

| Advertising Services | $31,160 | $37,739 |

| AWS | $62,202 | $80,096 |

| Other* | $2,176 | $4,247 |

| Total | $469,822 | $513,983 |

You can see how some categories experienced a loss (online stores) while others experienced a slight increase or a dramatic increase.

*”Other” refers to Amazon’s licensing and distribution of video content and shipping services as well as their co-branded credit card offerings.

Source: Amazon’s Annual Report for 2022

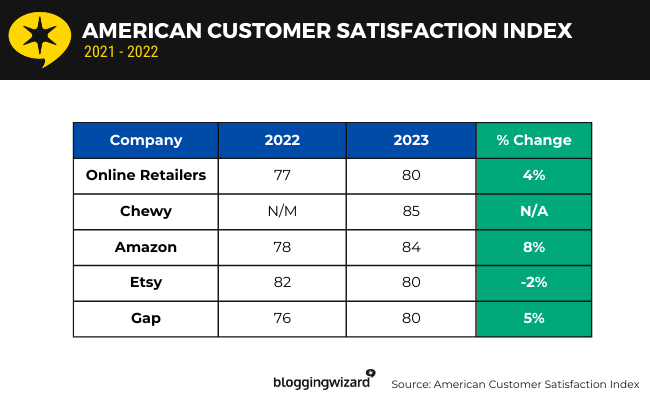

6. Amazon ranks No. 2 on the American Customer Satisfaction Index list

The American Customer Satisfaction Index (ACSI) currently ranks Amazon an 84 on its index for online retailers, putting it in the No. 2 position behind PetSmart-owned pet retailer Chewy, who has a rating of 85.

The average rating for online retailers is 80, and the rating for overall customer satisfaction in the United States is 73.6.

This means Amazon is above average as far as customer satisfaction goes.

In 2022, the ACSI gave Amazon a rating of 78, so 84 is a 7.69% increase from 2022’s rating.

Per the ACSI’s website, the company publishes its benchmarks by using a “science-based, proprietary methodology to analyze customer satisfaction for 10 economic sectors and over 40 key industries that together represent a broad swath of the national economy.”

Source: American Customer Satisfaction Index1, American Customer Satisfaction Index2

7. Amazon disposed of over 6 million counterfeit products in 2022

In a news report published in April of 2023, Amazon explained how one of their biggest goals to improve the customer experience on Amazon.com and its regional sites is by reducing and eliminating the number of counterfeit products sold on the platform.

In 2022, they utilized industry-leading technology and recruited counterfeiting experts to identify and seize 6 million counterfeit items that would have been sold on Amazon if not intercepted.

They also prevented 800,000 suspected bad actors from creating new Amazon seller accounts.

This was a huge improvement from 2021 and 2020’s numbers, which saw totals of 2.5 million and 6 million attempts to create malicious seller accounts.

Source: Amazon News Blog2

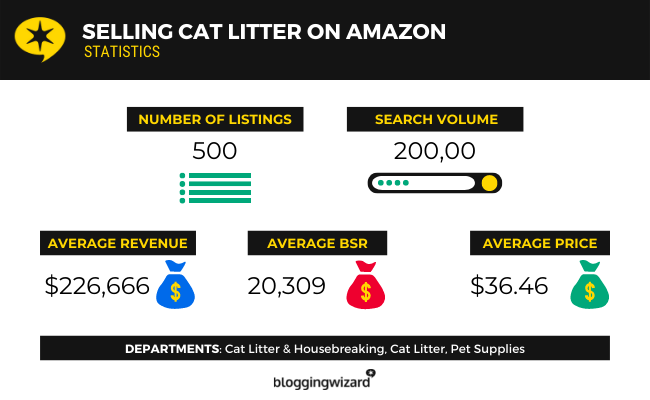

8. Cat litter is the best product to sell on Amazon with around 500 listings

Believe it or not, cat litter is the best product to sell on Amazon.

We conducted a bit of research to determine the best products to sell on Amazon in terms of competitiveness and interest.

We found that cat litter has a search volume of 200,000 on the platform but only 500 listings at the time.

This makes it a prime candidate for selling as it has a high amount of interest but a low amount of competition.

Other great products to sell are wifi extenders, wireless chargers, posture correctors, tablets and cat food.

Source: Blogging Wizard

Amazon Prime statistics

9. There are more than 200 million Amazon Prime subscribers

In his first annual letter to shareholders as Amazon’s new CEO, Andy Jassy said that more than 200 million customers have Amazon Prime memberships.

This letter was published in April of 2022.

Source: Amazon CEO’s Annual Letter to Shareholders – 2021

10. 76.6 million households in the United States have Amazon Prime subscriptions

Statista estimates that 76.6 million households in the United States have an Amazon Prime membership.

This is an increase of 15.36% from 2019’s total of 66.4 million US-based Amazon Prime subscriptions.

Source: Statista2

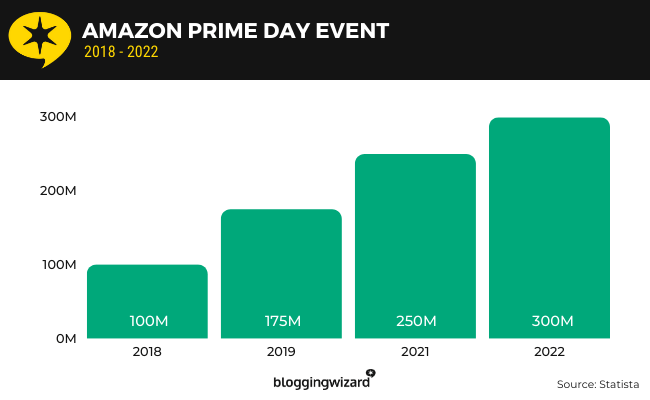

11. Global Amazon Prime Day sales reached $12 billion in 2022

According to data collected by Statista, global sales for Amazon’s Prime Day sales event in 2022 reached $12 billion, a record high.

Prime Day is an Amazon sales event available exclusively to Amazon Prime members in which numerous products across Amazon’s various websites receive discounted prices.

Because the event is available exclusively to Amazon Prime members, an Amazon Prime subscription is required in order to access the discounted prices during the event.

The event took place on July 12 and July 13 in 2022.

Statista’s data also revealed that small and medium sized businesses selling on Amazon generated nearly $3 billion in sales during 2022’s event.

In the United States, about a third of Amazon Prime subscribers shopping online during the Prime Day event bought household essentials.

28% bought products in the health and beauty categories.

In total, Amazon Prime members purchased 300 million items during the Prime Day event in 2022.

This was a 20% increase from 2021’s number of 250 million items sold.

Finally, sales by third-party sellers made up 37% of all Prime Day sales in 2022, which is down from 2015’s share of 45.5%.

Source: Statista3, Statista4, Statista5, Statista6, Statista7

12. 31% of Amazon Prime members in the U.S. spend between $51 and $100 on Amazon each month

According to a survey conducted in 2021, in which 2,003 Amazon Prime members responded, 31% of Amazon Prime members in the United States spend between $51 and $100 per month shopping on Amazon.

26% spend less than $50 while 23% spend between $101 and $200.

Source: Statista8

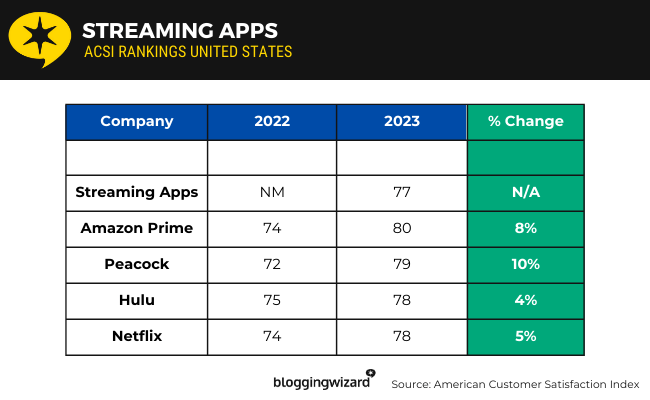

13. Amazon Prime Video is No. 1 on the American Customer Satisfaction Index

The ACSI ranks Amazon’s video streaming service Amazon Prime Video in the first position on its list of the top streaming apps in the United States.

It has a rating of 80, putting it above the overall satisfaction rating for streaming apps, which is 77, as well as the ratings for other popular streaming services, including Peacock, which has a rating of 79, and Hulu, Netflix, Paramount+ and YouTube Premium, who all have ratings of 78.

Amazon Prime Video’s rating was 74 in 2022, so 80 is an 8.12% increase from 2022’s rating.

Amazon Prime Video has free content any customer can access, and they also allow you to use your Amazon account to make movie and video rental purchases.

Customers can access premium content by subscribing to Amazon Prime.

Source: American Customer Satisfaction Index3

App-related Amazon statistics

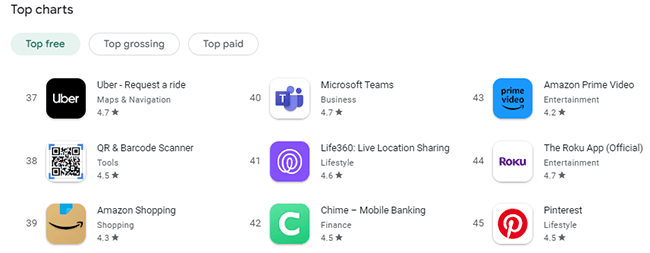

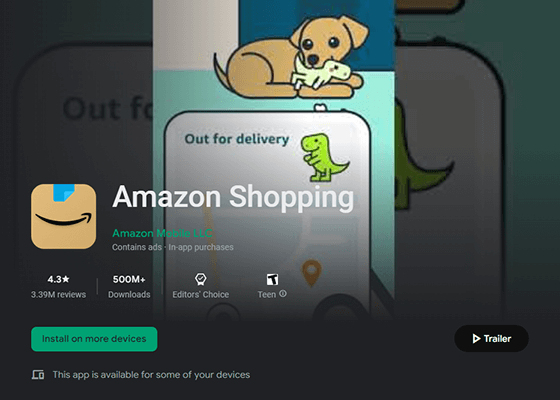

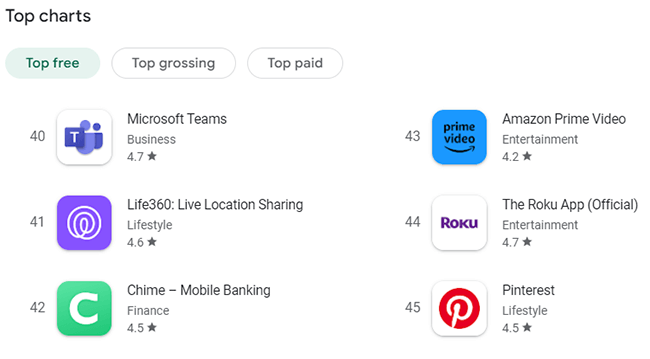

14. The Amazon Shopping app ranks No. 39 on the top free apps list on Google Play

At the time this article was written, the Amazon Shopping app ranked No. 39 on the top free apps list on Google Play, the official app store for Android and ChromeOS devices.

This puts it behind one of its biggest competitors, Walmart, who ranks No. 21 on the list.

The app has over 500 million downloads and a 4.3-star rating out of 3.39 million reviews.

Source: Google Play1, Google Play2

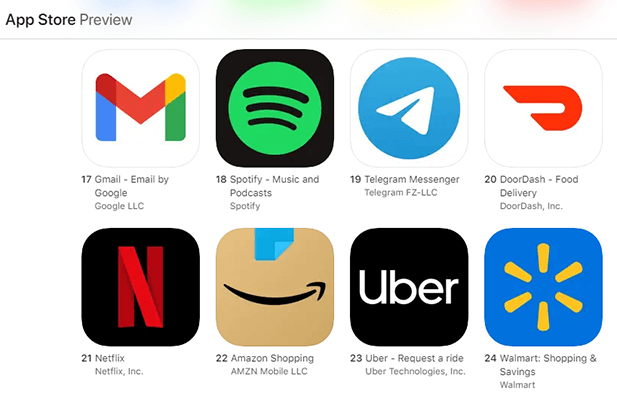

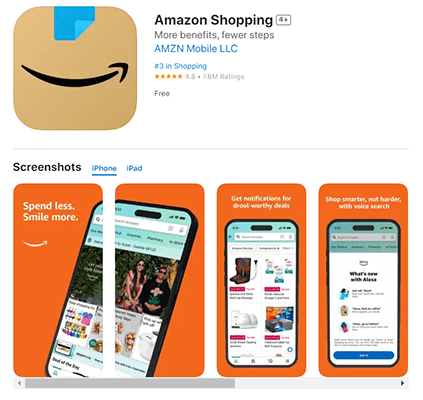

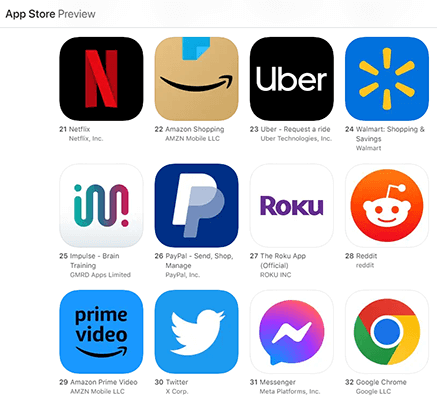

15. The Amazon Shopping app is No. 22 on the App Store

According to the App Store’s top charts list, the Amazon Shopping app ranks No. 22 among all apps on the list.

The App Store is Apple’s proprietary app for iOS devices.

This ranking places them two positions ahead of Walmart.

The app ranks #3 in the Shopping category and has a 4.8-star rating out of 7.6 million reviews.

Source: App Store1, App Store2

16. The Amazon Prime Video app ranks No. 43 on Google Play

According to Google Play’s ranking of the top free apps on its store, the Amazon Prime Video app ranks No. 43 on the store.

As a streaming app, this puts it behind competitors HBO Max (No. 2), Tubi (No. 13), Netflix (No. 19), Pluto TV (No. 28) and Disney+ (No. 30).

The app has over 500 million downloads and a 4.2-star rating out of 3.96 million reviews.

Source: Google Play3

17. The Amazon Prime Video app ranks No. 29 on the App Store

The App Store’s top charts list places the Amazon Prime Video app in the 29th position.

This puts them behind competitors HBO Max (No. 2), Netflix (No. 21) and Roku (No. 27).

The app ranks #5 in the Entertainment category and has a 4.7-star rating out of 9,200 reviews.

Source: App Store3

AWS-related Amazon statistics

18. AWS’ annual revenue run rate is now $85 billion as of 2022

According to Amazon CEO Andy Jassy’s annual letter to shareholders, Amazon’s subsidiary AWS reached an annual revenue run rate of $85 billion in 2022.

Amazon offers web hosting, CDN, cloud computing and cloud storage services through AWS.

Source: Amazon CEO’s Annual Letter to Shareholders

Amazon Business statistics

19. Gross merchandise sales from Amazon Business is now $35 billion annually

In his annual letter to shareholders, Amazon CEO Andy Jassy said that gross sales from Amazon Business is now $35 billion annually.

Amazon Business is essentially Amazon but for office supplies.

Businesses can use the service, along with a special business edition of Amazon Prime, to simplify the purchase of office products, janitorial supplies, IT products, restaurant supplies, breakroom supplies and more.

Source: Amazon CEO’s Annual Letter to Shareholders

20. 96 of global Fortune 100 companies are using Amazon Business

According to Amazon CEO Andy Jassy’s letter to shareholders, 96 of Fortune 100 companies around the world use Amazon Business.

According to Amazon’s landing page for Amazon Business, customers of the service include ExxonMobil, Citi, New Balance, Union Pacific and USO.

The service has over 6 million customers and is also used by “92 of the 100 largest hospital systems” and “90 of the 100 most populous local governments.”

Source: Amazon CEO’s Annual Letter to Shareholders, Amazon Business Landing Page

21. The U.S. Air Force used Amazon Business to make 7,600 purchases from 2,600 small businesses

When Amazon published their editorial on Amazon Business, they explained how one of the primary benefits of Amazon Business is the ability to choose who your organization buys products from and the ease of which it makes those options available.

They explained how the U.S. Air Force wanted to make more purchases from smaller, local businesses.

And so, spending $1.29 million, the US-based military branch made 7,600 purchases from 2,600 small businesses, businesses that were “woman-owned, veteran-owned, and businesses in historically underutilized business zones.”

Source: Amazon News Blog1

Sources

Final thoughts

These statistics prove Amazon’s influence in a variety of different industries, including ecommerce, online marketplace and video streaming.

At over 2 billion website visits per month, over $500 billion in net sales and hundreds of millions of app downloads, it’s easy to see just how powerful the retail giant is.

Even so, they still have quite a few competitors, including Walmart in the retail industry and eBay in the online marketplace industry.

We also didn’t mention a few of Amazon’s other competitors, namely Spotify, which is much more popular than Amazon Music, and Chinese-based ecommerce apps Temu and Shein, both of whom place ahead of Amazon Shopping on Google Play and the App Store.

If you’d like to read up on the ecommerce industry, check out a few additional posts we’ve published on the subject below.

Related posts: