26 Top Print-On-Demand Statistics And Trends (2024 Guide)

Interested in learning about the latest print-on-demand statistics?

In this post, we list the latest print-on-demand statistics from around the web.

We include statistics on the global print-on-demand market, print-on-demand companies and businesses who rely on print-on-demand services.

We even include statistics on the ecommerce industry as a whole.

Let’s get into it.

Editor’s picks – print-on-demand statistics

Here’s a quick list of our top five statistics from this post:

- The market size for the global print-on-demand industry will reach $7.67 billion by the end of 2023. (Grand View Research1)

- Printify received $50 million in funding following a Series A funding round in late 2021. (Printify1)

- The majority of successful print-on-demand merchants use profit margins of 40-45%. (Printify2)

- Successful print-on-demand merchants distribute products to consumers in eight to 16 countries around the world. (Printify2)

- The countries with the most successful print-on-demand merchants include the United States, United Kingdom and Canada. (Printify2)

General print-on-demand statistics

1. The global print-on-demand market size will reach $7.67B by the end of 2023

Market research on the print-on-demand industry by Grand View Research revealed the global print-on-demand market size to be $6.18 billion, as of 2022.

The company’s print-on-demand market report reveals that they expect this number to reach $7.67 billion by the end of 2023.

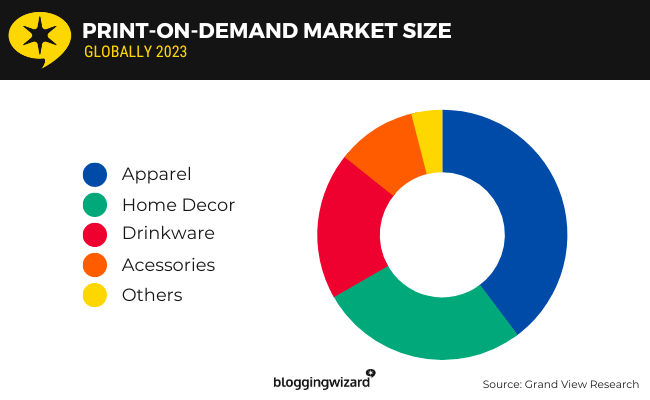

Apparel contributes to the global print-on-demand market size at the highest rate. Its market share was 39.7% in 2022.

Other popular categories include home decor, drinkware and accessories, in that order.

North America had the largest market share among the print-on-demand industry in 2022 with a market share of 35%, and this dominance is expected to remain intact throughout the growth period analyzed by Grand View Research.

Source: Grand View Research1

2. The global print-on-demand industry has a compound annual growth rate of 25.8%

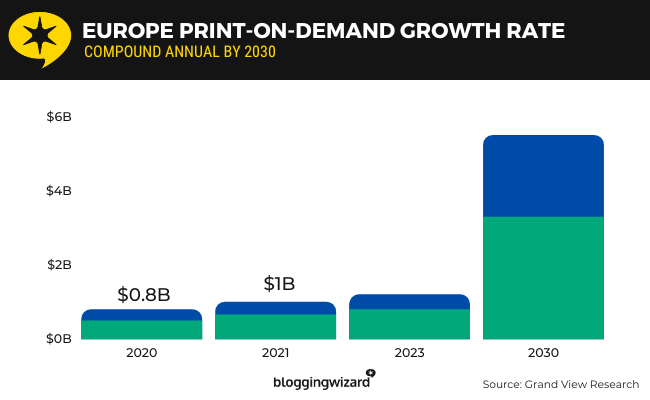

According to market research, the print-on-demand industry has a compound annual growth rate (CAGR) of 25.8% globally.

This means the global market size is expected to reach $38.21 billion by 2030.

Europe’s CAGR for this industry is 26.3%, but the Asian Pacific region will have the fastest growth rate at a CAGR of 27.5%.

The company who conducted the research, Grand View Research, also divided its findings into the service and software segments of the print-on-demand industry.

They discovered that the service segment will grow the fastest at a CAGR of 28.2%.

The integrated software segment will grow at a CAGR of 23.4% while the standalone software segment will grow at a CAGR of 26.4%.

And although the apparel category makes up the majority of the global print-on-demand market, the home decor category is expected to grow the fastest at a CAGR of 27.5%.

Source: Grand View Research1

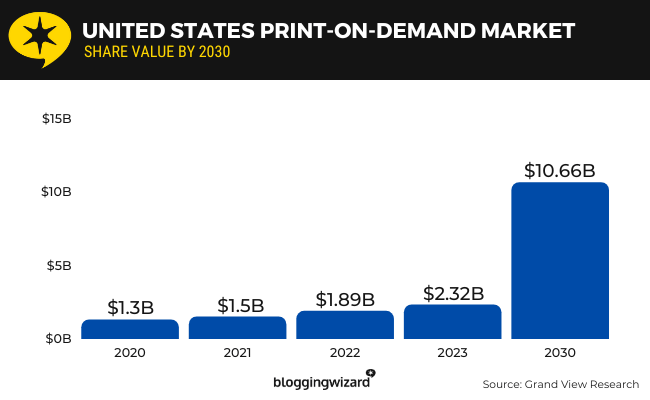

3. The U.S. print-on-demand market share was valued at $1.89B in 2022

According to market research conducted by Grand View Research on the print-on-demand industry in the United States, the market share for this industry was valued at $1.89 billion in the United States in 2022 alone.

This is up from $1.5 billion in 2021 and $1.3 billion in 2020.

The market has a CAGR of 24.4%. This is in line with the global CAGR for the print-on-demand industry, which is 25.8% as cited earlier.

The market share for the print-on-demand industry in the United States is expected to reach $2.32 billion by the end of 2023.

It’s expected to reach $10.66 billion by 2030.

Source: Grand View Research2

4. The global print-on-demand software market size was $2B in 2022

According to data collected by Future Market Insights, the global print-on-demand market size was $2 billion in 2022.

The company’s forecasts predict this number will increase to $30 billion by 2032 at a CAGR of 31.1%.

Companies analyzed in the report include Printful, Printify, Zazzle, Redbubble, VistaPrint and more.

Source: Future Market Insights

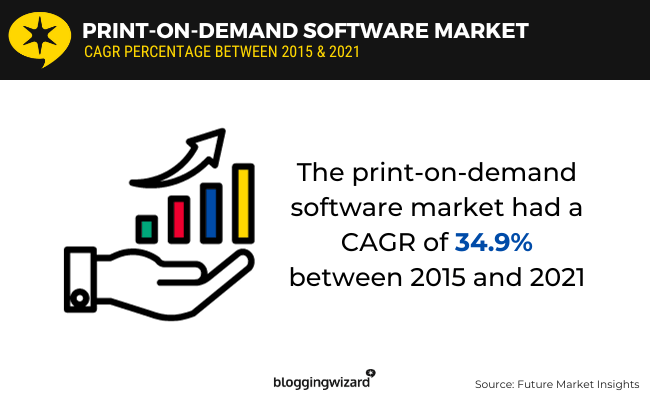

5. The print-on-demand software market had a CAGR of 34.9% between 2015 and 2021

Future Market Insights also reviewed the print-on-demand software industry’s historical data.

They discovered that the industry had a CAGR of 34.9% between 2015 and 2021.

This means that although the print-on-demand software industry experienced a boom during this period, future forecasts predict the industry to slow down based on our previously mentioned statistic, which predicts the industry to have a CAGR of 31.1% by 2032.

Source: Future Market Insights

6. The print-on-demand software market size will reach $10.7B in the United States by 2032

Future Market Insights’ report on the print-on-demand software industry also includes forecasts on the market size for the industry in the United States.

They expect the market size to reach $10.7 billion in the United States by 2032 at a CAGR of 30.8%.

Source: Future Market Insights

Print-on-demand statistics for print-on-demand companies

7. Printful’s revenue reached $289 million in 2021

Printful is a popular print-on-demand service based in the United States.

They print a wide variety of custom products for customers, including apparel, accessories and paper products.

According to a news report published by Printful themselves, the company’s revenue reached more than $289 million in 2021.

This was a 39% increase from 2020’s revenue of $208 million.

Source: Printful1

8. Printful fulfills over 1 million print-on-demand products for customers every month

According to Printful’s own numbers, the company fulfills over 1 million items for customers every month.

A news report on the company’s financial status, which was published in mid-2022 and is referenced above, explained how the company fulfilled over 48 million items by 2022 and reached a gross merchandise value (GMV) of $1 billion.

Part of this success has been attributed by a $32.4 million investment in printing equipment and tech products in 2021 alone. This brought the company’s total investments to $83.8 million.

Source: Printful2, Printful1

9. Gelato’s total revenue exceeded €107 million in 2022

Gelato is a Norwegian print-on-demand business who specializes in print-on-demand services countries in Europe, though the company fulfills and delivers orders to 184 countries.

The company primarily prints customized clothing for customers, including t-shirts and hoodies, but they also print posters, calendars, mugs and canvases.

According to a news report published on Gelato’s blog, the company’s total revenue surpassed €107 million in 2022, which meant the company’s revenue tripled between 2021 and 2022.

The company’s growth has been enabled by adding 34 production hubs to its network. By Gelato’s account, the company has the “world’s largest network for production on demand of personalized items.”

Source: Gelato

10. Over 85% of Gelato’s orders are produced in the same countries its end customers live in

Gelato’s huge network, which includes more than 130 production partners in 32 countries, allows it to fulfill global orders without facing cross-border shipping restrictions.

More than 85% of its orders are produced in the same countries the customers who will be receiving those orders live in because of this.

The company plans on expanding its network to 200 production hubs by the end of 2023, which will allow it to fulfill 95% of its orders locally.

Source: Gelato

11. Printify closed a $50M Series A funding round in November of 2021

Printify is a US-based print-on-demand service that services customers and fulfills orders located all around the world.

The company mostly prints custom, made-to-order t-shirts, phone accessories and paper products.

Printify announced it had closed a $50M Series A funding round in November of 2021.

Funding was completed by more than 40 investors, including Index Ventures, H&M Group, Virgin Group, Wise, Vinted, Squarespace, FJ Labs, Change Ventures and Dreamers VC.

$10 million of the funds went to Printify employees who sold their shares in the company, which brought their salaries up to six figures.

The rest of the funds have allowed Printify to “grow its team and develop the marketplace globally.”

Today, the company services more than 6 million merchants and has produced and delivered over $500 million worth of products produced in over 110 printing locations.

Source: Printify1

Print-on-demand statistics for businesses

12. Most mid to high-volume print-on-demand merchants maintain profit margins between 40 and 45%

Print-on-demand merchants rely on profit margins.

In case you’re not aware of how selling through a print-on-demand service works, you use the service’s software to create your own branded products by uploading your designs to the platform and attributing them to blank products like t-shirts, mugs, phone cases and more.

You then create an online store and integrate it with a service like Printify, who does the work of printing your design on a product and shipping it out to your customer on your behalf.

Services like these have multiple, affordable pricing plans, including free plans, and you only pay for products the service ships out to customers when orders are placed.

This means you don’t need to worry about having a warehouse full of merchandise paid for and printed out before you launch your online store, and you certainly don’t need to worry about shipping orders out yourself.

Because merchants pay the full price for whatever product their customer bought, merchants upcharge all products so they can still see profits.

So, according to Printify’s data of mid- to high-volume merchants maintaining 40-45% profit margins on most products, this means you’d charge $21 to $21.75 for a $15 t-shirt.

The print-on-demand service would keep the full $15 for that shirt while you’d keep the extra $6 to $6.75 in profits.

Source: Printify2

13. Most print-on-demand merchants sell to eight to 16 countries

According to Printify’s data on its own pool of merchants, most mid-volume print-on-demand merchants choose to sell merchandise to eight countries.

High-volume merchants sell to as many as 16 countries around the world.

Source: Printify2

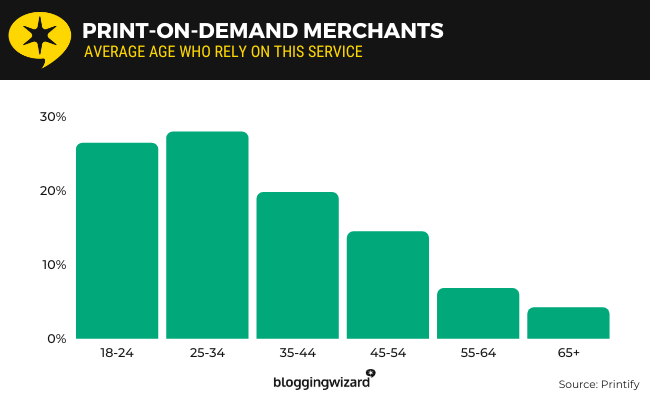

14. The average age range of merchants who rely on print-on-demand services is 18-35

According to Printify’s data on its customer base, the average age range of merchants who rely on print-on-demand services to fulfill merchandise orders is between 18 and 35 years old.

However, Printify also says its merchants range from as young as 18 to over 65 years old.

Source: Printify2

15. The most successful print-on-demand merchants are based in the US, the UK and Canada

According to Printify’s data on its merchants, the most successful print-on-demand merchants are based in the United States, United Kingdom and Canada.

Australia, Germany, Vietnam, Turkey and The Netherlands follow close by.

As Printify is a US-based print-on-demand service, it makes sense for their most successful merchants to also be based in the United States.

States who have the most active merchants include California, Ohio, Texas, Florida, Georgia, New York, Virginia and Illinois.

Source: Printify2

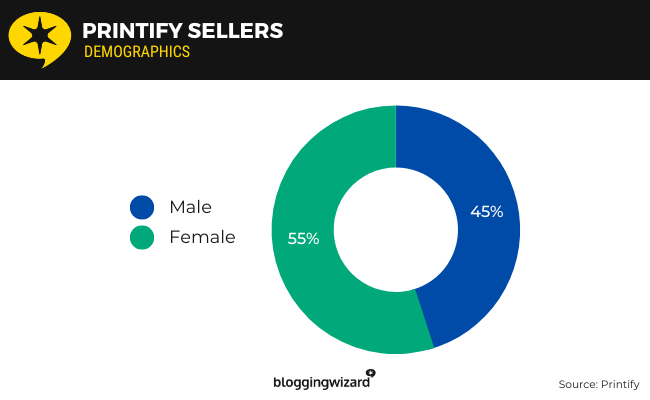

16. 55% of print-on-demand merchants are female

According to Printify’s data on its own merchants, 55% of merchants are female.

With 45% of merchants being male, this means there’s a pretty even split between genders who utilize print-on-demand services the most.

Source: Printify2

General ecommerce statistics

Print-on-demand, while not an ecommerce-only type of service, owes its recent rise to prominence to ecommerce.

The print-on-demand industry’s booming success has been widely attributed to the rapid growth the ecommerce industry as a whole has experienced.

We feel it’s important to include key ecommerce statistics because of this. All of the metrics in this section are taken from our post dedicated to ecommerce statistics.

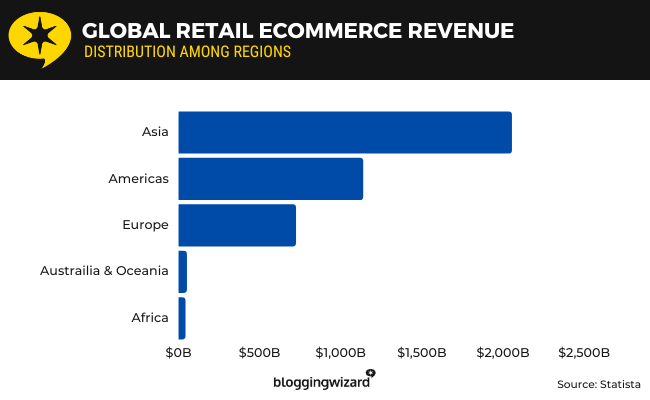

17. Revenue generated by global ecommerce sales will reach $4T by 2024

Statista collects data on the global ecommerce market.

They found that, based on sales forecasts, revenue from global ecommerce sales will amount to more than $4 trillion by 2024.

The forecast also predicts how that revenue will be distributed across the globe, with Asia dominating the industry:

- Asia – Revenue from ecommerce sales will reach $2.06 trillion globally by 2024

- North and South Americas – $1.1 trillion

- Europe – $722 billion

- Australia & Oceania – $49 billion

- Africa – $40.2 billion

Source: Statista1

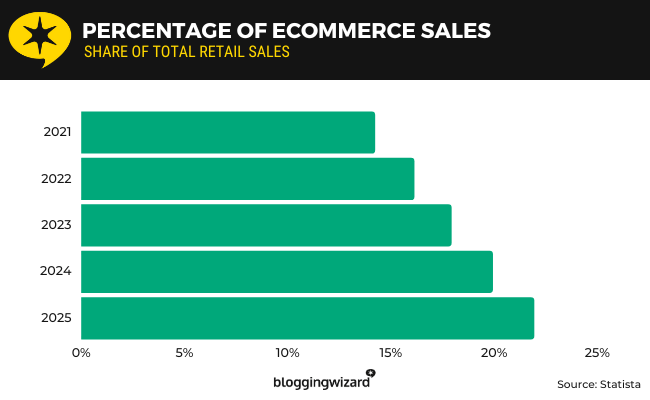

18. Ecommerce sales will make up 21.9% of all retail sales by 2025

Statista’s data on ecommerce sales also reveals how much of the retail industry ecommerce sales will contribute over the next few years.

They predict that ecommerce sales will make up 21.9% of all retail sales by 2025.

Ecommerce sales made up 14.2% of all retail sales in 2021.

Source: Statista2

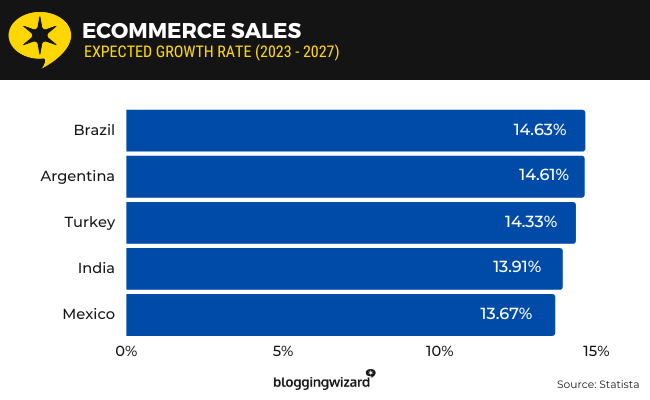

19. Retail ecommerce sales are expected to grow at a CAGR of 11.34% globally

The ecommerce industry’s increase in sales is also attributed to a growing CAGR, which is 11.34% globally, according to data collected by Statista.

These regions will have the highest CAGR between 2023 and 2027:

- Brazil – The region’s CAGR will be 14.63% between 2023 and 2027.

- Argentina – 14.61%

- Turkey – 14.33%

- India – 13.91%

- Mexico – 13.67%

Source: Statista3

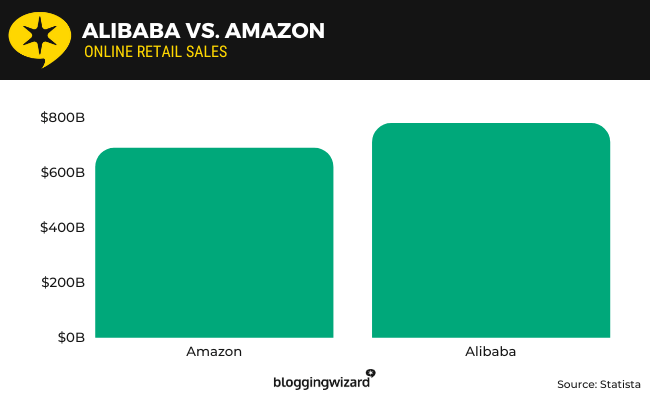

20. Alibaba Group is the world’s leading online retailer with annual sales totalling $780B

According to Statista’s research on the ecommerce industry, Alibaba Group is the world’s leading online retailer. They generate over $780 billion in sales annually.

Alibaba owns AliExpress, one of the leading dropshipping sites in the world.

Dropshipping is a sister service to the print-on-demand industry as it fulfills orders on behalf of its clients and ships products out as orders come in.

Amazon is the second leading online retailer, generating $690 billion in revenue annually.

It’s expected to surpass Alibaba in revenue by 2027, at which point Amazon’s annual revenue will reach $1.2 trillion.

Source: Statista4

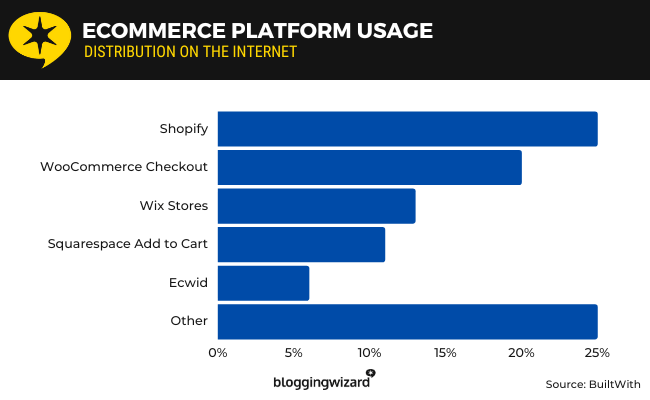

21. 25% of all ecommerce stores use Shopify

According to data collected on a list of ecommerce platforms by BuiltWith, 25% of all ecommerce stores on the web use Shopify, an all-in-one ecommerce platform.

Shopify integrates with most leading print-on-demand services, allowing businesses who rely on print-on-demand services to build ecommerce websites with Shopify but power order fulfillment through print-on-demand services.

Furthermore, 19% of the top 10,000 ecommerce websites use Shopify.

Source: BuiltWith1, BuiltWith2

General statistics from around the printing industry

This section includes a collection of market size statistics from other areas of the printing industry.

We’re including these as anything that can be printed (legally) can eventually be printed on demand if such a company decides to offer that service.

Plus, some industries, such as the printing ink industry, are essential for the print-on-demand industry.

22. The automotive 3D printing market size is expected to grow to $15.8B by 2032

According to research conducted by Market.Us, the global automotive 3D printing market size will reach $15.8 billion by 2032 at a CAGR of 22.4%.

This is up from $2.2 billion in 2022.

Primary use cases include prototyping and tooling, research and development, and production.

Source: Market.Us1

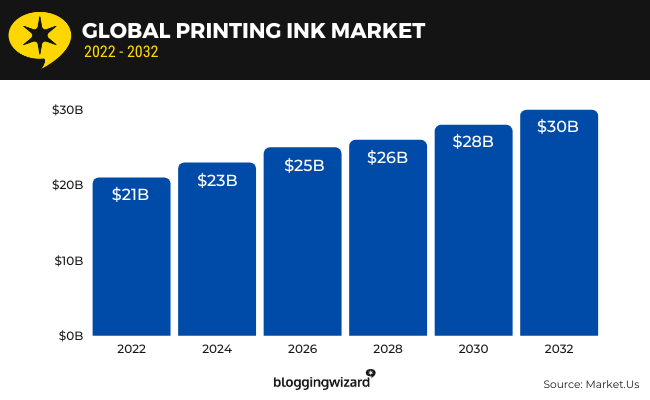

23. The global printing ink market was valued at $21.2 billion in 2022

According to Market.Us’ research on the printing ink industry, the market size for this industry was $21.2 billion in 2022.

That number will increase to around $30 billion by 2032 at a CAGR of 3.8%.

The most common use cases for printing ink include gravure, flexographic, lithographic and digital printing, in that order.

Source: Market.Us2

24. The A4 laser printer market size was $2.02 billion in 2022

Market.Us’ research on the printing industry included research on the A4 laser printer market.

They found the market size for this industry to be at $2.02 billion in 2022.

They expect it to increase to $9.2 billion at a CAGR 16.4%.

Source: Market.Us3

25. The commercial printing market size will be worth $469.8 billion in 2023

The commercial printing market as a whole will have a much slower growth than the print-on-demand industry.

The commercial printing market size is expected to reach $586.2 billion by 2032, which is only a CAGR of 2.3% from 2023’s market size of $469.8 billion.

Common use cases for commercial printing include lithographic printing, digital printing, screen printing, gravure printing and flexographic printing.

Source: Market.Us4

26. The 3D printing plastic industry will have a market size of $6.8 billion by 2032

The 3D printing plastic industry is expected to boom between 2023 and 2032.

Market.Us’ research on this forecast period reveals the industry to experience a CAGR growth rate of 24.6%.

So, while the 3D printing plastic industry’s current market size is valued at $797 million, it’s expected to reach a whopping $6.8 billion by 2032.

Source: Market.Us5

Sources

Final thoughts

That concludes our list of print-on-demand statistics.

Print-on-demand companies provide an invaluable service to merchants, especially newer merchants who are just starting out.

If you’re considering starting an online business or adding merch as a revenue stream to your overall marketing strategy, we highly recommend checking out a few print-on-demand services.

These types of services are beneficial for a few different reasons:

- They don’t require thousands and thousands of dollars of upfront costs.

- You won’t need to store boxes full of merchandise in a warehouse or your garage.

- You only pay for products when customers place orders, so you can easily manage your budget.

- You can start selling merchandise faster as, once again, you don’t need to worry about paying huge upfront costs or worrying about where you’re going to store everything.

- The print-on-demand service will handle order fulfillment for you, taking care of printing costs and inventory management costs, so you won’t need to worry about processing orders, packaging them and shipping them out yourself, which means…

- …you also don’t need to worry about hiring extra employees to handle order fulfillment.

Lastly, print-on-demand companies are helping solve a huge problem that’s exacerbated by the ecommerce industry, and that’s fast retail, such as “fast fashion.”

This is a practice in which companies design and produce large amounts of merchandise and promote it for a short period of time in an effort to drive consumer interest.

The problem is when consumer interest is too low, all of that merchandise gets thrown out in favor of newer products merchants hope will entice consumers more.

This has the potential to have negative impacts on the environment.

When you use a print-on-demand service, products are only produced after orders are placed.

This helps reduce problems like fast fashion that contribute to pollution.

So, the next time you’re thinking of starting an online business, give a few print-on-demand services a peek.